Current Situation of the Fresh Avocado Market in the US

The U.S. avocado market continues to expand its consumption, but domestic producers are facing challenges that have eroded their competitiveness. Factors such as water shortages and a shortage of labor have impacted domestic avocado production. As a result, the United States has increasingly relied on imports, benefiting producers in other countries, particularly Mexico, which boasts regions with favorable climatic conditions for year-round avocado cultivation.

Before the 1990s, Americans primarily consumed avocados during the summer when California’s harvest was available. They supplemented their avocado consumption with imports, primarily from Chile, during the rest of the year. However, the introduction of avocados from Michoacan, Mexico, led to the availability of high-quality avocados throughout the year, transforming consumption habits.

In 2022, U.S. avocado production reached 156,900 metric tons, marking a slight increase of 4.1% compared to 2021 but a significant drop of 24.1% from 2020 levels. Avocados are cultivated in just three states in the U.S.: California, Florida, and Hawaii. California accounted for the majority of production at 88.3% in 2022, while Florida and Hawaii contributed 11.5% and 0.2%, respectively, according to data from the National Agricultural Statistics Service (NASS).

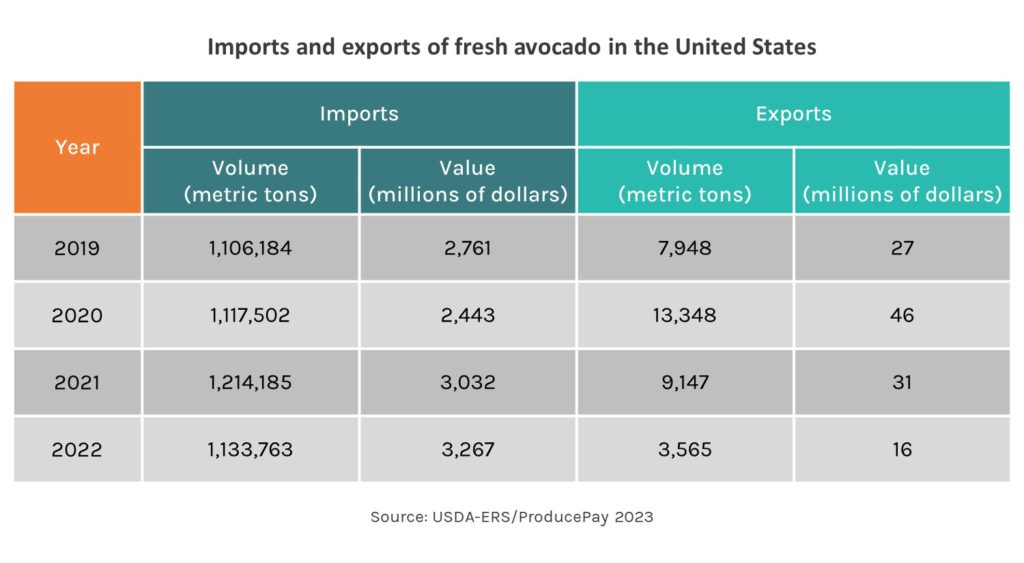

Imports and exports trends

In 2022, the United States imported 1,133,763 metric tons of avocados, valued at $3.27 billion. Although the import volume decreased compared to 2021, the value increased due to high prices in 2022, as reported by the Economic Research Service (ERS).

Meanwhile, exports in 2022 amounted to just 3,565 metric tons and $16 million, representing the lowest figures in recent years, indicating a declining role for exports in the market.

US avocado suppliers

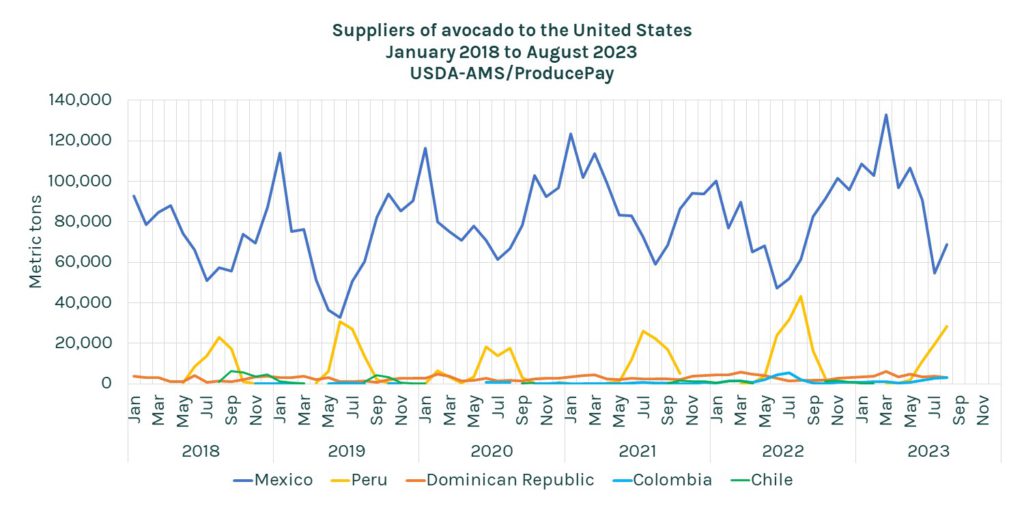

According to data from the Agricultural Marketing Service (AMS), the top five suppliers of fresh avocados to the U.S. market are Mexico, Peru, the Dominican Republic, Colombia, and Chile.

Mexico stands out as the dominant supplier, providing the highest volumes from October to May, while Peru capitalizes on the low season to ship its avocados. The volumes from the other countries are considerably lower.

Mexico, the king of avocados

Mexican avocado imports reached 931,826 metric tons in 2022, making Mexico the dominant supplier to the U.S. market, accounting for 83.3% of total imports. Estimates suggest that this volume will continue to rise in the coming years.

Peru, a far runner-up

Peru’s avocado export season is well-defined in the middle of the year, allowing it to compete with Mexico when there is less volume available in the market. It’s important to note that Peru exports more avocados to the European Union than to the United States.

Dominican Republic, holding steady

Although the Dominican Republic’s contribution in terms of volume is minimal compared to Mexico, its export volumes have remained stable, with slight growth in recent years.

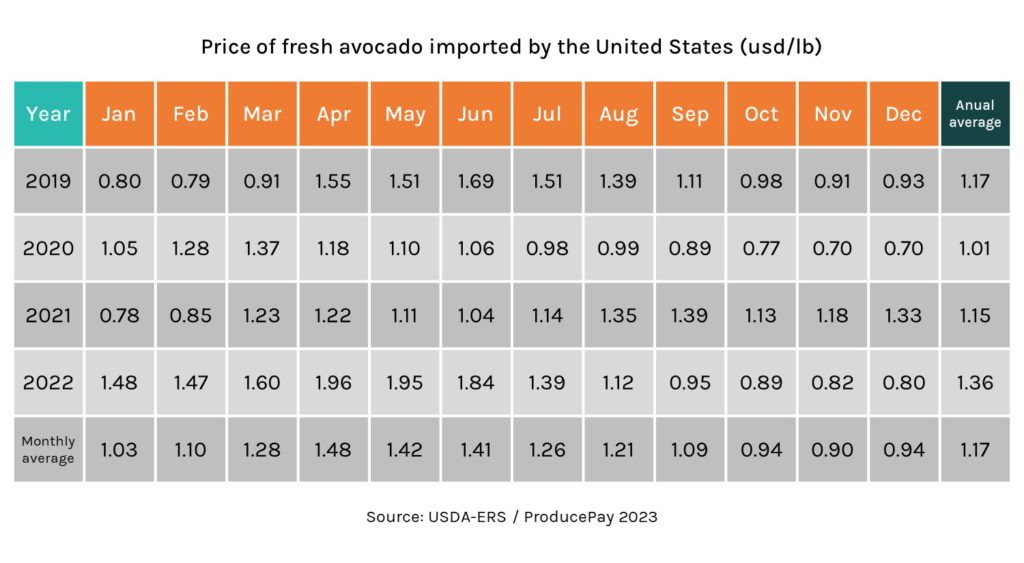

Price of imported fresh avocado

The average annual price for avocados imported by the United States was 1.36 dollars per pound in 2022. Prices were highest in April, May, and June, while the lowest prices were observed in December, November, and October.

Typically, prices decline from September onward, remaining low for several months due to Mexico’s increased avocado exports to the United States. In contrast, prices rise between April and August because Mexico exports fewer avocados during these months, resulting in lower market supply.

Market Outlook for 2024

Over the past decade the fresh avocado market in the United States has seen steady growth. According to data from the Association of Avocado Exporting Producers and Packers of Mexico (APEAM), Mexico has emerged as the primary supplier of fresh avocados to the U.S., accounting for over 80% of recent imports.

American consumers’ preference for Hass avocados, primarily produced in Mexico, coupled with the trade liberalization facilitated by the USMCA, has solidified this trade relationship.

Looking ahead to 2024, the upward trend for fresh avocados in the United States is projected to continue. Factors such as increasing awareness of the nutritional benefits of avocados, including their high content of healthy fats, fiber, and potassium, will continue to drive consumption. Additionally, marketing campaigns and promotions focused on innovative recipes and uses for avocados, from salads to desserts and smoothies, will play a pivotal role in sustaining consumer interest.

However, it’s essential to note that sustainability and environmental concerns associated with intensive avocado production might influence consumer perception and purchasing practices in the near future.

On the other hand, the diversification of suppliers is a trend that could gain traction in 2024. While Mexico has dominated the U.S. avocado market, countries like Peru, Chile, and Colombia have also increased their presence in the American market.

Diversifying avocado supply sources can offer consumers a more consistent product availability throughout the year and potentially stabilize prices. Furthermore, adapting to climate change, investing in agricultural technologies, and adopting sustainable practices will be crucial to meet the rising demand and tackle market challenges.

Do you produce and/or sell avocados?

At ProducePay, we offer solutions to enhance your agribusiness. If you sell avocados, you can get working capital and optimize your cash flow. And if you buy avocados, you can tap into our network of sellers and make faster payments to them. Our solutions include:

- Trading Platform: Streamline your supply chain by connecting directly with our verified sellers.

- Pre-Season: Secure tailored working capital for your business to manage operational and harvesting expenses.

- Quick-Pay: Enhance your cash flow by receiving fast payments for your shipments, with options upon shipping or upon buyer’s acceptance.

- Insights: Real-time market intelligence that augments USDA data in a more user-friendly format.